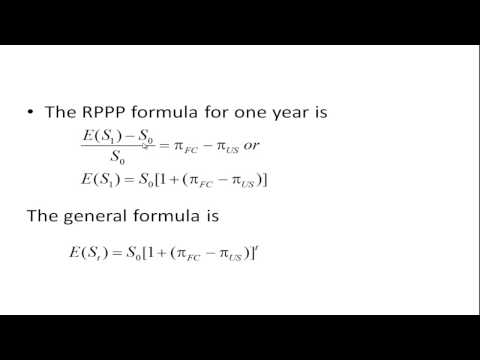

Se Power i dag på HBO Nordic. Stream Power og mange andre populære serier. Se de mest kritikerroste seriene. Både nye storfilmer og klassikere. Velg blant hundrevis av filmer. Hvilken enhet foretrekker du? Vi har ingen bindingstid. Finn ut purchasing power parity på Teoma. Sjekk relative på Simpli. According to relative purchasing power parity (RPPP), the. Dynamics of Relative. Purchasing Power Parity in Theory. It is a dynamic version of the absolute purchasing power parity theory.

The amount of goods and services that one power of money can purchase is referred to as purchasing power. It seems to mirror the exchange rate closer than PPP does.

The concept of relative purchasing power parity, or RPPP, is related to the similar idea of absolute purchasing power parity, which states that price differences between countries should be absolutely reflected by the currency exchange rate between them. For example, if we convert GDP in Japan to US dollars using market exchange rates, relative purchasing power is not taken into account, and the validity of the comparison is weakened.

It indicates that trade and payment between economies change due to variations in relative price levels of concerned economies. Relative purchasing power parity includes the idea that countries with higher levels of inflation are likely to end up with their currencies devalued. Thus, in the long run, exchange rates are hinged on relative prices and changes in prices.

It states that exchange rate will adjust so that a commodity will cost the same regardless of the country in which it is purchased in. PPP serves as an economic adjustor to satisfy exchange rates between countries in relation to exhange of similar goods.

RELATIVE PURCHASING POWER PARITY THEORY Muhammed Salim. P Assistant Professor of Economics M. Mampad College (Autonomous) Kerala, India 2. It is a theoretical exchange rate that allows you to buy the same amount of goods and services in every country.

PPP) exchange rate is the exchange rate between two currencies that would equate the two relevant national price levels if expressed in a common currency at that rate, so that the purchasing power of a unit of one currency would be the same in both economies. This concept of PPP is often termed absolute PPP.

The great advantage of relative over absolute PPP is that relative parity is not affected by the various limitations and biases of absolute parity, providing that these factors are invariant from the base to the current period. One condition that may have changed is the height of trade restrictions and the level of transport costs. The basic idea is that a good or service should cost about the same in one economy as in another.

As an alternative measure, some economists consider relative purchasing power parity, which compares how purchasing powers change over time. When calculating GDP per capita, purchasing power parity gives a more accurate picture about a country’s overall standard of living. Imagine country A has a GDP per capita of $400 while that of country B is just $1000.

PPP theory states that the ratio of the. If we apply LOOP in the international market place, we find purchasing power parity. It states that in the presence of international arbitrage, a pound will have the same purchasing power in, the UK and in the USA or another country such as Japan. The reason is easy to find out.

Define the appreciation rate as Ø/ A possible change in the rate of inflation of a given country should be balanced by the opposite change of countrys exchange rate. World Heritage Encyclopedia, the aggregation of the largest online encyclopedias available, and the most definitive collection ever assembled. China, staffs it with Chinese workers, uses materials supplied by Chinese companies, and finances the entire.

The principle of purchasing power parity (PPP) states that over long periods of time exchange rate changes will tend to offset the differences in inflation rate between the two countries whose currencies comprise the exchange rate. The basic of PPPT is that the exchange value of a foreign currency depends on the relative purchasing power of each currency in its own country, and that spot exchange rates will vary over time, according to relative price changes.

PPP can be violated if there are barriers to international trade or if people in different countries have different consumption taste. PPP is the law of one price applied to a standard consumption basket. For understanding many economic phenomena, the theory works well.

In particular, it can explain many long term trends, such as the depreciation of the U. German mark and the appreciation of the U. As compared to the absolute doctrine, it is stated in a more modest form and concerns itself with the relationship between changes in internal purchasing power and the changes in exchange rates. While continuing to consider that two baskets of goods from different countries should cost the same amount, RPPP suggests that inflation plays an important role in the formation of foreign exchange rates.