Sjekk " purchasing power parity " oversettelser til norsk bokmål. Se gjennom eksempler på purchasing power parity oversettelse i setninger, lytt til uttale og lær grammatikk. Kjøpekraftsparitet (KKP), på engelsk purchasing power parity (PPP), går ut på at man får kjøpt den samme mengden varer i utlandet som man ville gjort i sitt eget land etter å ha tatt hensyn til valuta-kursene. The description is composed by our digital data assistant.

What is purchasing power parity? Purchasing power parity., den frie encyklopedi. Kjøpekraftsparitet ( PPP ) er en måling av prisene i forskjellige land som bruker prisene på spesifikke varer for å sammenligne den absolutte kjøpekraften til landenes.

It is based on the law of one price, which says that, if there are no transaction costs nor trade barriers for a particular goo then the price for that good should be the same at every location. This is done through a basket of commonly bought goods which measures the difference in price between two nations.

For instance, a Big Mac in the US may cost $ whilst it costs £in the UK. PPP actually increased revenue. These are independent creators offering massive discounts (from their perspective—the point of parity is that it’s not equitable from other perspectives), relying mostly on the honesty system. But they experienced higher sales precisely because more people can now afford it.

They indicate how many currency units a particular quantity of goods and services costs in different countries. Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on. It is a theoretical exchange rate that allows you to buy the same amount of goods and services in every country.

If an imaginary product costs $in the United States, and ¥2in Japan, one would expect the exchange rate to be $to ¥200. When calculating GDP per capita, purchasing power parity gives a more accurate picture about a country’s overall standard of living. Imagine country A has a GDP per capita of $400 while that of country B is just $1000.

The purchasing power parity was originally designed as an attempt to find a unified unit of measurement to compare currency values around the world. The initial concept focused on the idea that a collection of similar retail items should cost the same amount of money everywhere in the world. It states that the price levels between two countries should be equal. This means that goods in each country will cost the same once the currencies have been exchanged.

PPP is based on the law of one price, which states that identical goods will be having the same price. According to this theory exchange rate between two currencies of two country depends upon purchasing power to buy same basket of goods in both countries. In its calculation, the purchasing power parity does not take into account the exchange rate but the cost of living in general through a basket of goods and services.

A: PPP formula indicates that a country with relatively higher expected inflation will be suffered from currency depreciation against another country with lower expected inflation. A: With strong economic theory support. ABSOLUTE PURCHASING POWER PARITY (PPP) Example: A Big Mac in China costs 12. Arbitrage o Borrow $1.

The basket of goods and services priced is a sample of all those that are part of final expenditures. The con-sequences of this qualification will be emphasized later on.

The alternative to using market exchange rates is to use purchasing power parities (PPPs). The purchasing power of a currency refers to the quantity of the currency needed to purchase a given unit of a goo or common basket of goods and services.

Absolute purchasing power parity occurs when two currencies have the same purchasing power, so an identical product would cost the same amount of money in both countries. The PPP doctrine claims that the foreign exchange rate is determined by the ratio between the real purchasing power of two currencies.

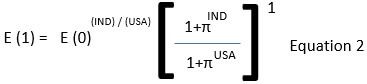

The price levels of the two countries would thus be the Independent variables, the exchange rate the dependent variables of the relationship. Relative purchasing power parity is an economic theory which predicts a relationship between the inflation rates of two countries over a specified period and the movement in the exchange rate between their two currencies over the same period.

It is a dynamic version of the absolute purchasing power parity theory. For understanding many economic phenomena, the theory works well. In particular, it can explain many long term trends, such as the depreciation of the U. German mark and the appreciation of the U. This page list all the various possible anagrams for the sentence purchasing power parity.

Use it for solving word puzzles, scrambles and for writing poetry, lyrics for your song or coming up with rap verses. PPPs are the rates of currency conversion that equalize the purchasing power of different currencies by eliminating the differences in price levels between countries.

In their simplest form, PPPs are simply price relatives that show the ratio of the prices in national currencies of the same good or service in different countries. The theory of purchasing power parity or PPP claims that the currency exchange rate between two countries adjusts to changes in the price of a basket of the same goods and services in both countries.

In turn, the theory derives from the low of one price that states that two identical goods must have the same price in any country, and any change in pricein an adjustment in the exchange rate. PPP) is a disarmingly simple theory that holds that the nominal exchange rate between two currencies should be equal to the ratio of aggregate price levels between the two countries, so that a unit of currency of one country will have the same purchasing power in a foreign country.

No claims are made regarding the accuracy of GDP – purchasing power parity information contained here. All suggestions for corrections of any errors about GDP – purchasing power parity should be addressed to the CIA. If the dollar yuan exchange rate was allowed to move entirely with market forces, the theory of purchasing power parity says that the exchange rate should move to around yuan to the dollar.

Until that happens, this price discrepancy will remain. There are all sorts of problems with purchasing power parity but I will not go into them here.

The basic concept of purchasing power parity theory or PPP relates to the purchasing power of a dollar. PPP relies on the price of goods and services remaining constant across comparisons, often referred to as the law of one price.